——————————

Date: June 26th, 7:15pm

Venue: MIT E51-325 (http://mitiq.mit.edu/MITIQ/

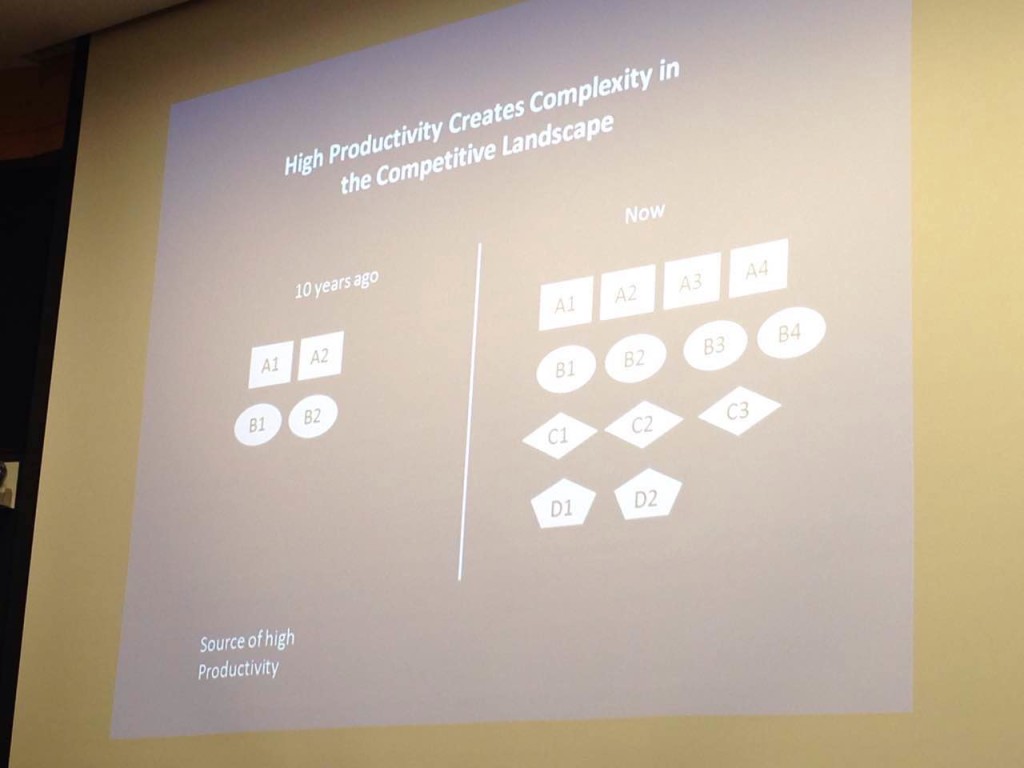

Topic: Biotech Investing in the Era of High Productivity –My journey and My challenge–

Speaker: Jingsong Xu, Ph.D.

https://docs.google.com/forms/

Dr. Jingsong Xu was Assistant Professor of Medicine at Harvard Medical School and is currently the portfolio manager and founder of Growth Vision Asset Management, a startup asset management company specialized in investing in small to mid cap US biotech companies.

Dr. Xu obtained his Ph. D in developmental biology from Washington University School of Medical. He worked at Harvard Medical School from 2002 to 2008 as a faculty member and a principal investigator. His academic research covered a broad range of fields including extracellular matrix biology, neural development, tyrosine kinase receptor signaling, skeletal development, lung development, asthma, lung cancer and COPD.

In 2008 he established equity research consulting firm BioEssence Consulting, LLC and provided consulting service to 3 biotech asset management firms and a Chinese biotech company. In June 2008 he started to invest his own capital in the biotech industry and has been focusing on developing a strategy for identify young biotech companies with high growth potential. In the meantime he studied and passed all three levels of CFA exams. By 2012 he believed that his strategy had matured and started to manage all his family’s financial asset. By May 2013 he established his investment advisory firm Growth Vision Asset Management and began managing clients’ asset. Over the past 3.5 years he has generated an annualized return of 46.7%.

In his presentation, he will discuss his investment process, philosophy and his personal journey in biotech investing. He will also provide his own perspectives on the biotech industry and the challenges he faces as a biotech investor and his strategy for these challenges.

BCIC(Boston Chinese Investment Club): 波士顿华人投资协会(BCIC)是由波士顿的华人金融投资人士(

GCC(MIT Sloan Greater China Club): The mission of the Greater China Club is to build a close-knit community for the growing number of Sloan students who are interested in issues, events and activities related to the Greater China region.