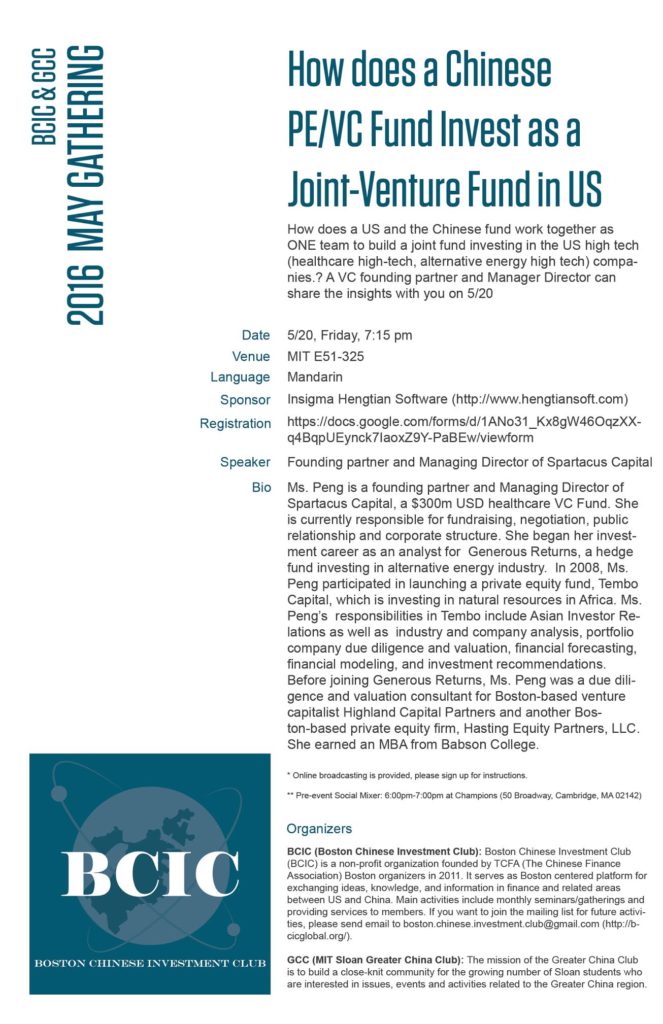

BCIC & GCC 2016 May Gathering

How does a Chinese PE/VC Fund Invest as a Joint-Venture Fund in US, 5/20 Friday, MIT E51-325

How does a US and a Chinese fund work together as ONE team to build a joint fund investing in the US high tech (healthcare high-tech, alternative energy high tech) companies.? A VC founding partner and Manager Director can share the insights with you on 5/20.

————————————————————————————-

Title:How does a Chinese PE/VC Fund Invest as a Joint-Venture Fund in US

Speaker:

Suxiang Peng, Founding Partner and Managing Director of Spartacus Capital

Date:5/20,Friday, 7:15pm

Venue:MIT E51-325

Language:Mandarin

Sponsor: Insigma Hengtian Software (http://www.hengtiansoft.com)

Registration:

https://docs.google.com/forms/d/1ANo31_Kx8gW46OqzXXq4BqpUEynck7IaoxZ9Y-PaBEw/viewform

* Online broadcasting is provided, please sign up for instructions.

Parking: (http://mitiq.mit.edu/MITIQ/Directions_%20ParkingE51.htm)

** Pre-event Social Mixer: 6:00pm–7:00pm at Champions (50 Broadway, Cambridge, MA 02142)

Bio:

Ms. Peng is a founding partner and Managing Director of Spartacus Capital, a $300m USD healthcare VC Fund. She is currently responsible for fundraising, negotiation, public relationship and corporate structure. She began her investment career as an analyst for Generous Returns, a hedge fund investing in alternative energy industry. In 2008, Ms. Peng participated in launching a private equity fund, Tembo Capital, which is investing in natural resources in Africa. Ms. Peng’s responsibilities in Tembo include Asian Investor Relations as well as industry and company analysis, portfolio company due diligence and valuation, financial forecasting, financial modeling, and investment recommendations. Before joining Generous Returns, Ms. Peng was a due diligence and valuation consultant for Boston-based venture capitalist Highland Capital Partners and another Boston-based private equity firm, Hasting Equity Partners, LLC. She earned an MBA from Babson College.

Organizers

BCIC (Boston Chinese Investment Club): Boston Chinese Investment Club (BCIC) is a non-profit organization founded by TCFA (The Chinese Finance Association) Boston organizers in 2011. It serves as Boston centered platform for exchanging ideas, knowledge, and information in finance and related areas between US and China. Main activities include monthly seminars/gatherings and providing services to members. If you want to join the mailing list for future activities, please send email to boston.chinese.investment.club@gmail.com (https://bcicglobal.org/).

GCC (MIT Sloan Greater China Club): The mission of the Greater China Club is to build a close-knit community for the growing number of Sloan students who are interested in issues, events and activities related to the Greater China region.